MORTGAGE OPERATIONS

No overlays... No excuses... No issues...

Your home for “On Time and As Agreed.”

ORIGINATION RESOURCES

Efficiency is key.

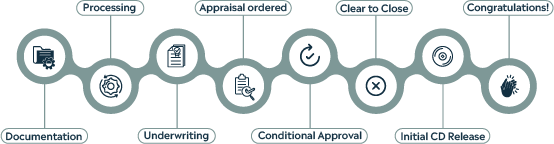

With industry natives as our key visionaries and the majority of our staff position in support, your success is our priority. Assigned underwriting teams and our closing technology take the hassle out of originating so you can focus on what you do best, growing your business.

OUR COMMITMENT

On time and as agreed.

We maintain a strong model by managing to a 30-day close but we grow by being able to consistently close in 12-15 days.

Assigned underwriting teams give you the ability to pick up the phone and reach out to your designated underwriter at any time, making a 2-week problem anywhere else a 20-minute solution here at InterLinc. Our “on time and agreed” commitments to our borrowers and referral partners:

- Pre-qualifications issued within 8 business hours

- Underwriting decision within 3 business days from receiving a complete file

- Closing docs out by 2nd business day upon final approval

ECLOSE & PRE-FUNDING

Save time, avoid delays.

Using Hybrid Close, our online closing technology, you will deliver faster, more accurate and seamless closing transactions. All in a few short steps, borrowers can review their entire loan package online and eSign many of their closing documents. Pre-funding is also exercised on all eligible loan files, sending the funding notice to the closing agent no later than the next morning.

EMPLOYEE TESTIMONIALS

See why our crew loves it here.

Hear from our very own about why they choose to make InterLinc their home.