TECHNOLOGY

Empowering Efficiency & Innovation

Recognized by Inc 5000 for our tech innovations, InterLinc is leading the way in technological advancements. Our originators reap the rewards of these innovations through enhanced efficiencies.

INTERLEADS

Lead intake from the palm of your hand.

InterLeads is a cutting-edge mobile application tailored for InterLinc Originators. It revolutionizes the way you gather, categorize, and oversee information regarding prospective customers or leads. Say goodbye to laborious manual data entry; InterLeads optimizes the entire lead acquisition process through automation.

NCINO

More than a point-of-sale, a business multiplier & full 1003 intake

NCino, formerly known as Simple Nexus, is a robust, 1003 intake, point-of-sale tool right out of the box, but at InterLinc, our development team has taken it a step further, transforming it into a true business multiplier. We’ve achieved this by empowering our Loan Originators to share their mobile app with their Realtor partners, creating a cobranded mobile experience that adds substantial value.

- Order Credit

- Personalized Mobile App

- Issue Pre-Approvals

- View Loan Status via Borrower Portal

- Utilize Several Mortgage Calculators

- Upload Docs with Direct LOS Import

- Hybrid Close

- Co-Brand with Realtors

- Smart Notifications

ENCOMPASS

High-Efficiency Loan Origination System.

Encompass is an all-in-one solution for loan management from application to funding.

- Order credit

- Request pricing and lock rate

- Run DU and LP

- Order VOAs, appraisals, flood certs, MI rate quotes and FHA case numbers

- Generate rapid disclosure packages

- eClose option

- Send closing docs directly to title

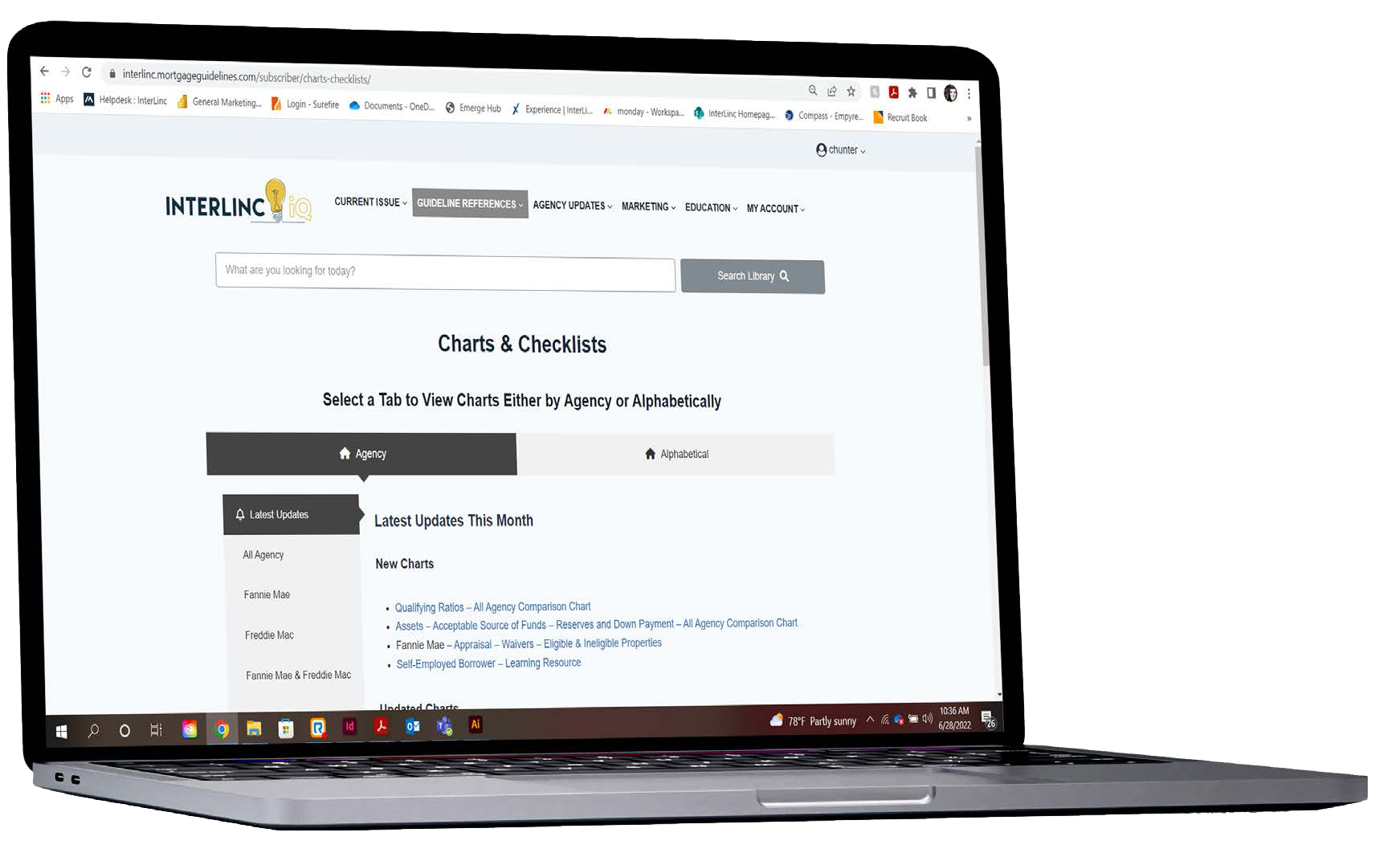

INTERLINC IQ

Stay ahead of shifting mortgage guidelines.

Mortgage guidelines change frequently, but your access to up-to-date information shouldn’t. Find product information and guidelines on InterLinc IQ, your go to destination for quick answers and educational resources. With InterLinc IQ, your underwriting questions are at your fingertips.

ILOT

Your Compensation, On Time & As Agreed!

With InterLinc’s custom loan originator compensation tool, ILOT (“InterLinc On Time”), originators start their day with real-time, personalized insight into their pipeline and earnings.

HYBRID CLOSE & PREFUNDING

Efficiency at the Closing Table.

We save you time and prevent delays with our advanced online closing technology, Hybrid Close. With the push of a button, borrowers can review and electronically sign their loan documents. Utilizing our proprietary pre-funding process, we give you and your referral partner the security and confidence that the funds are available for disbursement the morning of your closing.

EMPLOYEE TESTIMONIALS

See why our crew loves it here.

Hear from our very own about why they choose to make InterLinc their home.